Retirement income calculator with pension and social security

Or widower our Government Pension Offset GPO Calculator can tell you how your benefits may be affected. Common sources of retirement income that are taxable include.

The 10 Best Retirement Calculators Newretirement

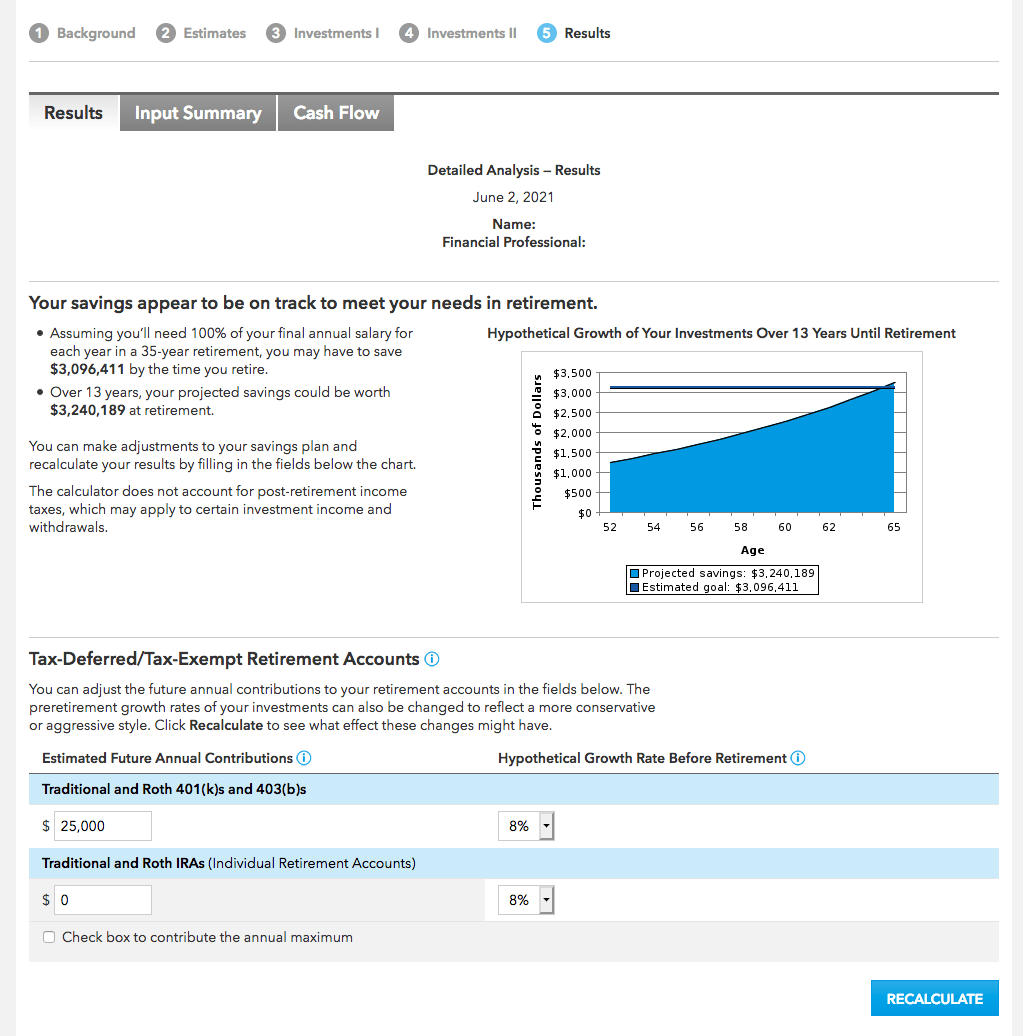

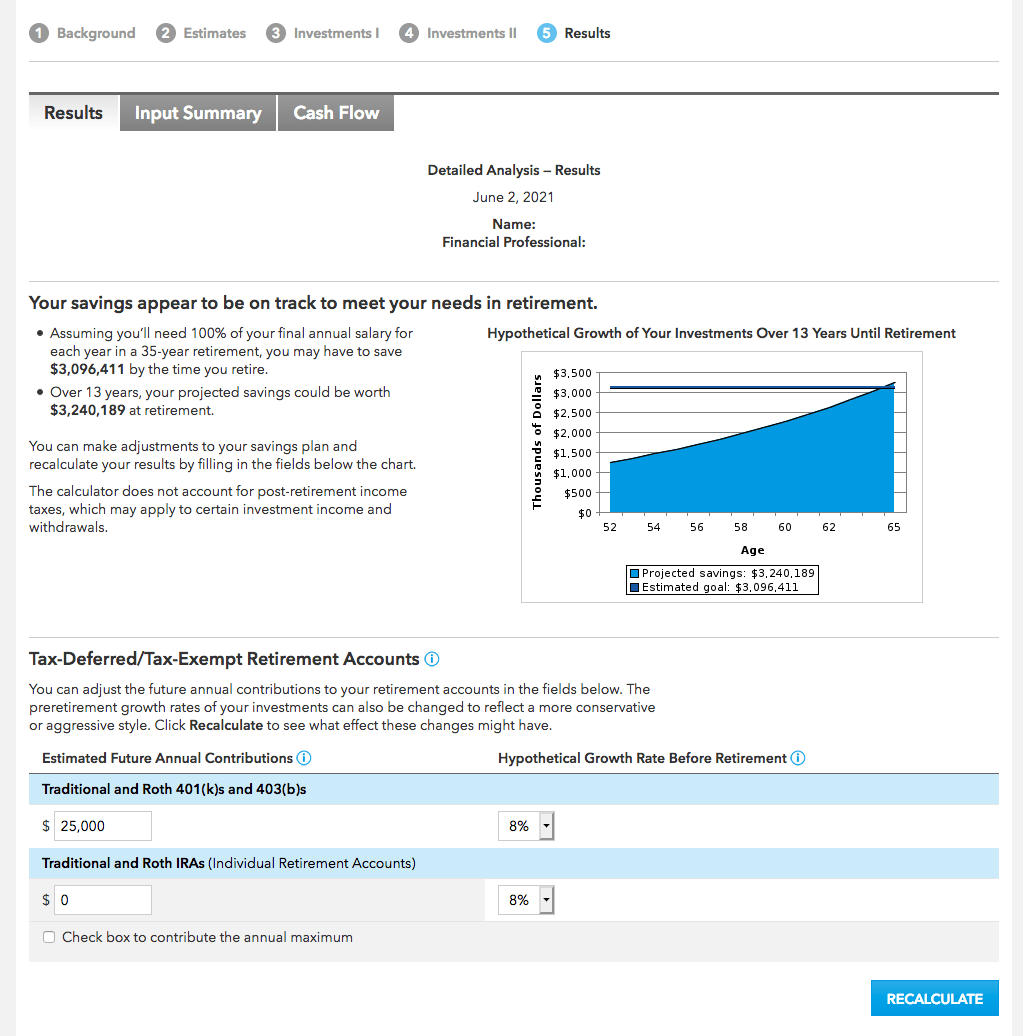

Retirement calculators vary in the extent to which they take taxes social security pensions and other sources of retirement income and expenditures into account.

. Social Security The majority of Americans 65 years of age and over 84 to be exact receive monthly benefits via the Social Security Old Age. Well help you explore ways to see how much money you could have every month using a mix of predictable income and savings. While its property tax rates are higher than average the average total sales tax rate is among the 20 lowest in the country.

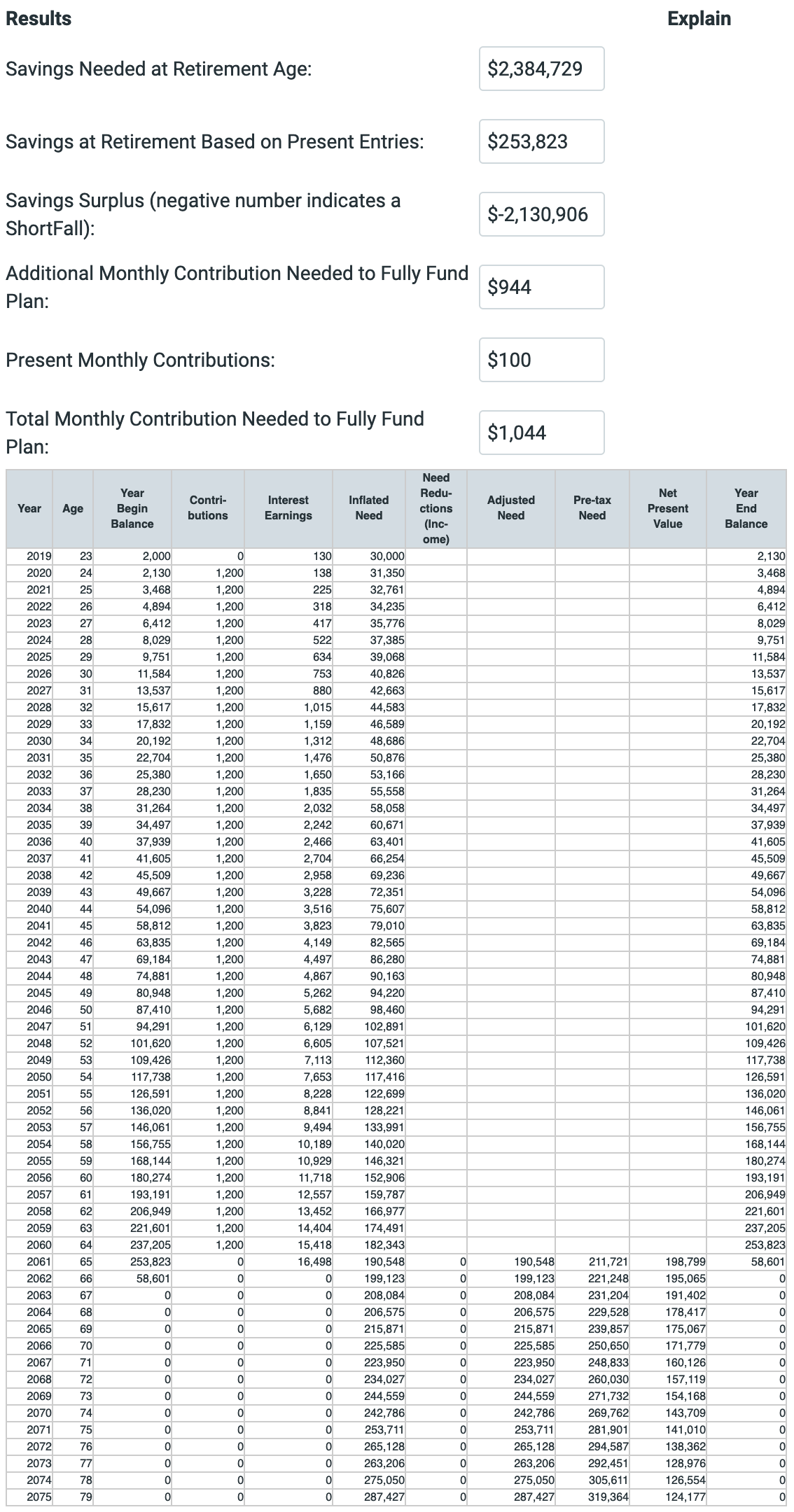

Use this calculator to help you create your retirement plan. The assumptions keyed into a retirement calculator are critical. See where you stand with our retirement income calculator.

Now that you know how the pension is built lets go over some examples. These cost-of-living increases which started in 1975 with 8 have ranged from no increase to 143. Our Social security calculator powered by Envestnet MoneyGuide is designed to help make a clients decision easier.

One of the most important assumptions is the assumed rate of real after inflation investment return. The exemption is based on your age starting at age 55. WEP does not affect benefits for your survivors.

This is not a. Your future retirement account balance including ongoing contributions by you andor your employer pension benefits Social Security retirement benefits and other retirement income you identify. Social security is a foundational part of a retirement income plan and deciding when to start collecting monthly benefits is an important decision.

Also if you begin receiving benefits before your full retirement age FRA. If you are CSRS Offset social security benefits may be subject to CSRS Offset at age 62. Social Security pensions and annuities are a few ways to build your predictable income.

The ATO calculates your transfer balance cap based on when you started your first retirement income stream and the highest ever balance of your transfer balance account. All figures take account of inflation and show the buying power of your pension in todays money. The AARP retirement calculator and the CalcXML offering do allow you to enter a monthly pension and an annual adjustment for it.

You can replace your pre-retirement income using a combination of savings investments Social Security and any other income sources part-time work a pension rental income etc. Retirement Pension Planner Do you know what it takes to work towards a secure retirement. Lets say your FERS Pension numbers look like this-High-3.

Pensions 401ks Individual Retirement Accounts IRA and Other Savings. Use the Online Benefits Calculator to estimate your monthly Social Security benefits by entering the annual earnings shown on your Social Security Statement. Between 16 million and 17 million if youve had a retirement income stream before 1 July 2021 but didnt reach the 16 million cap.

You can include information about supplemental retirement income such as a pension or Social Security consider how long you intend to work and think about your expected lifestyle as a retiree. If you are under the CSRS retirement plan not CSRS Offset its possible that you may have a social security benefit if you had worked at least 40 credits prior. Your estimated monthly retirement income may come from multiple sources.

If you have any questions call our Pensions Helpdesk. However here are four additional less personalized retirement calculator with pension options. For those who do retire with a pension plan the median annual pension benefit is 9262 for a private pension 22172 for a federal government pension and 24592 for a railroad pension.

Distributions from traditional 401k and IRA accounts. A portion of your Social Security benefits in some situations. It also exempts pension income for seniors age 60 or older.

Unlike other retirement income sources Social Security benefits are adjusted to keep pace with inflation. You also need to enter the monthly amount of your pension that was based on work not covered by Social Security. Please see how to read these results below.

Social Security is calculated on a sliding scale based on your income. This income isnt subject to market movement and can last for the rest of your life. Colorados pension-subtraction system exempts up to 24000 in pension and annuity income including some Social Security benefits.

What this translates to is that low income-earners have more to gain from their initial investments into Social Security relative to higher-income earners. For more information or to do calculations involving Social Security please visit our Social Security Calculator. If all of your pension income is covered by Social Security you do not need to use this calculator and you can use the more straightforward Online Calculator instead.

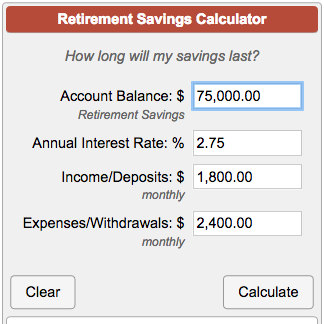

Some calculators like the CNN Money calculator group pensions with Social Security and other income. View your retirement savings balance and your withdrawals for each year until the end of your retirement. Youll be able to compare what you may have with what you think youll.

A shortfall is presented if your monthly goal amount is estimated to. Simply answer a few questions about your household status salary and retirement savings such as an IRA or 401k. Pennsylvania fully exempts all income from Social Security as well as payments from retirement accounts like 401ks and IRAs.

And for the purpose of these examples well keep the numbers simple and clean. Social Security Benefit Use the Social Security Benefit calculator to calculate this input.

Start Planning With Our Fers Retirement Calculator Retirement Benefits Institute Retirement Calculator Retirement Benefits Retirement Planner

The 10 Best Retirement Calculators Newretirement

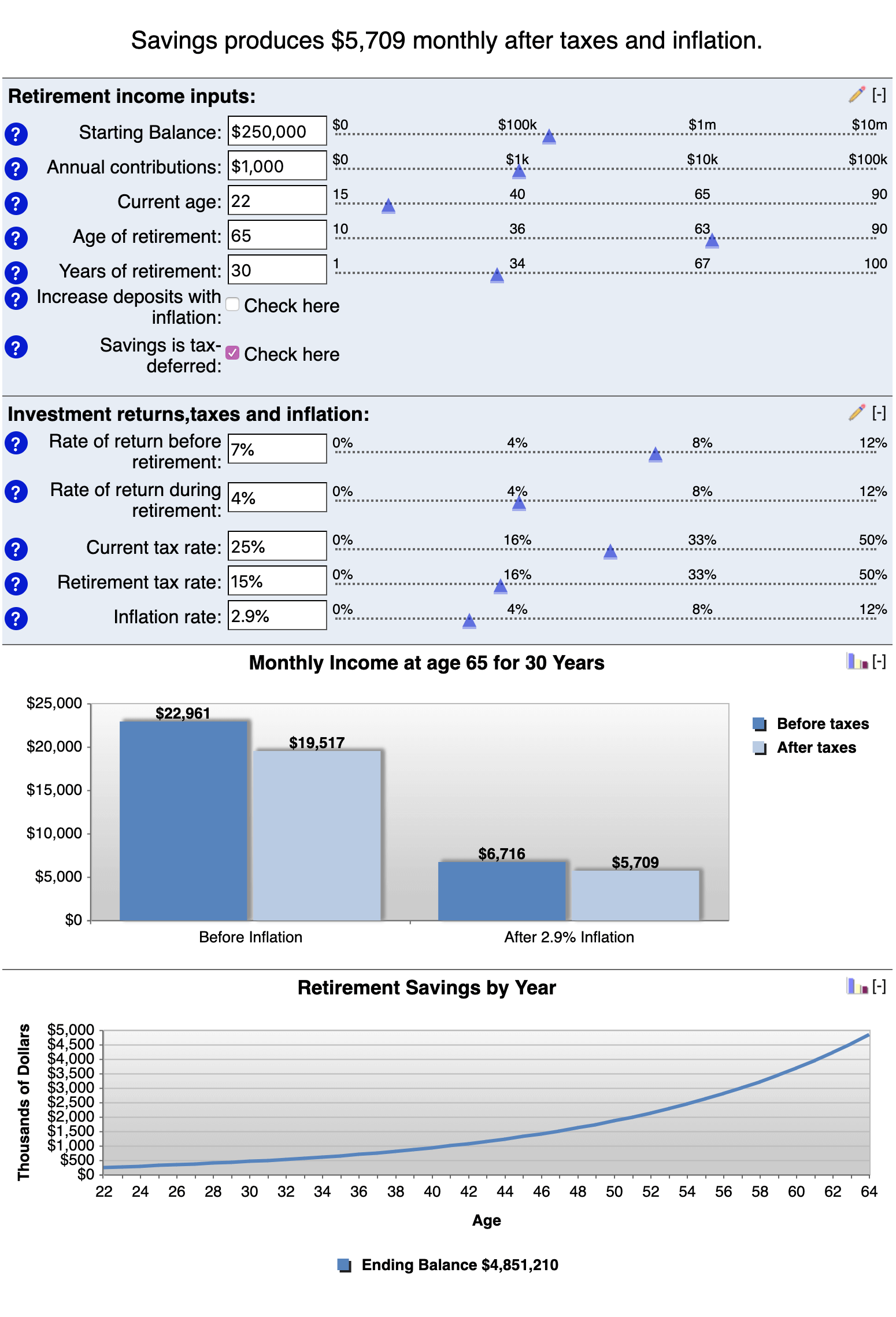

Retirement Savings Calculator

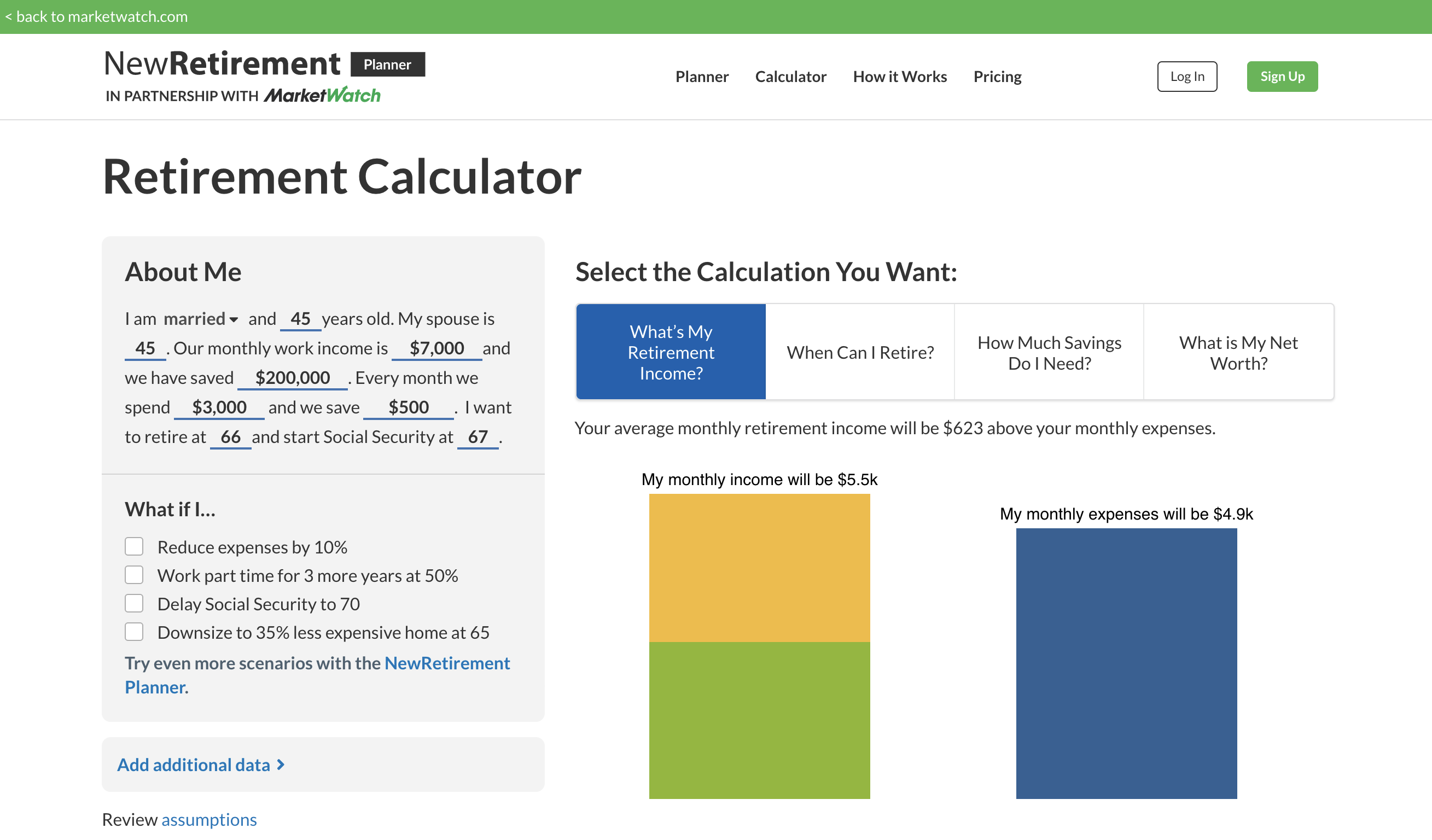

The 10 Best Retirement Calculators Newretirement

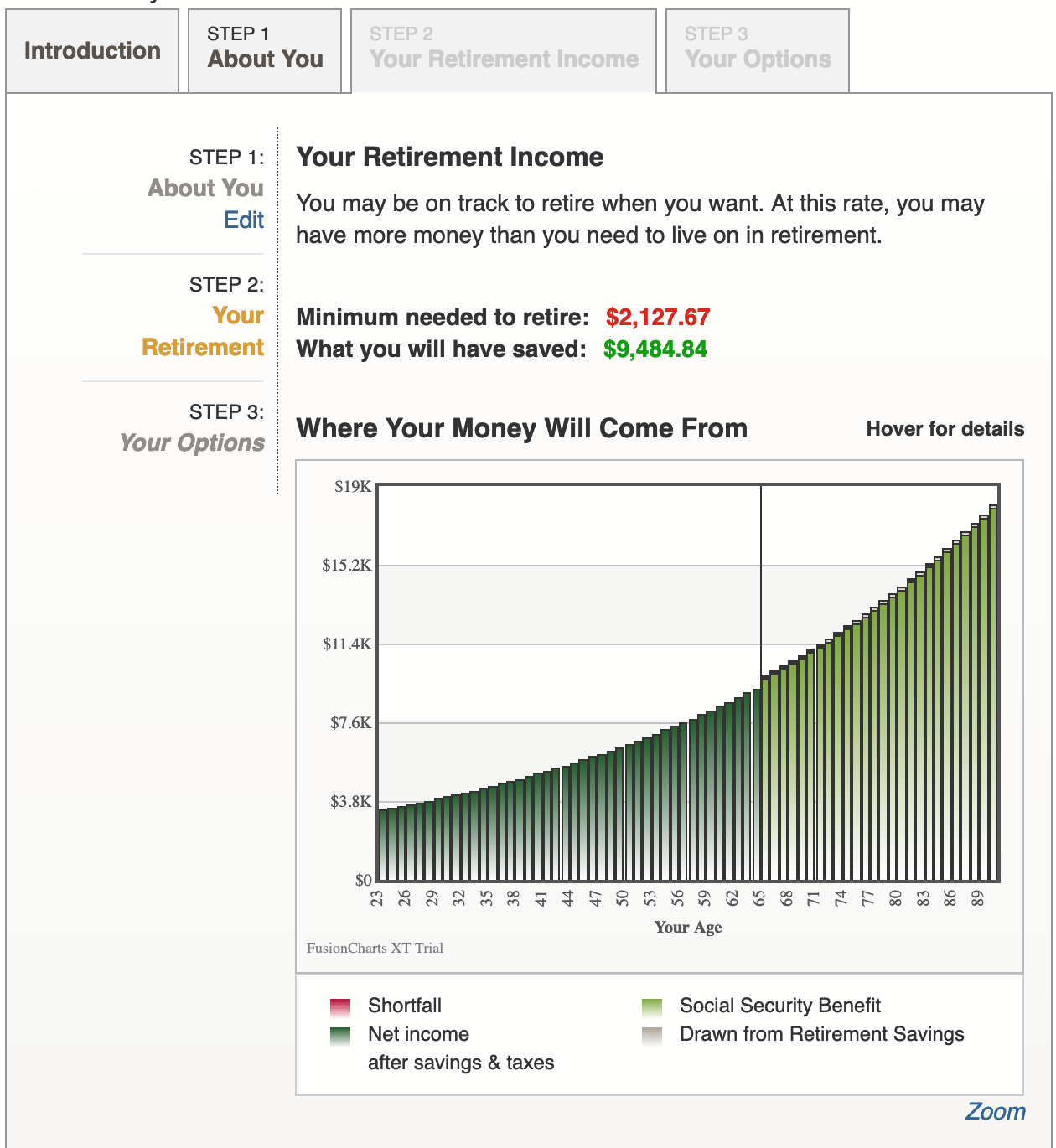

The 10 Best Retirement Calculators Newretirement

Learn How To Manage Your Pension How To Use Online Tools To Estimate It How To Calculate The Value Of A Lump Sum Finance Investing Pensions Annuity Calculator

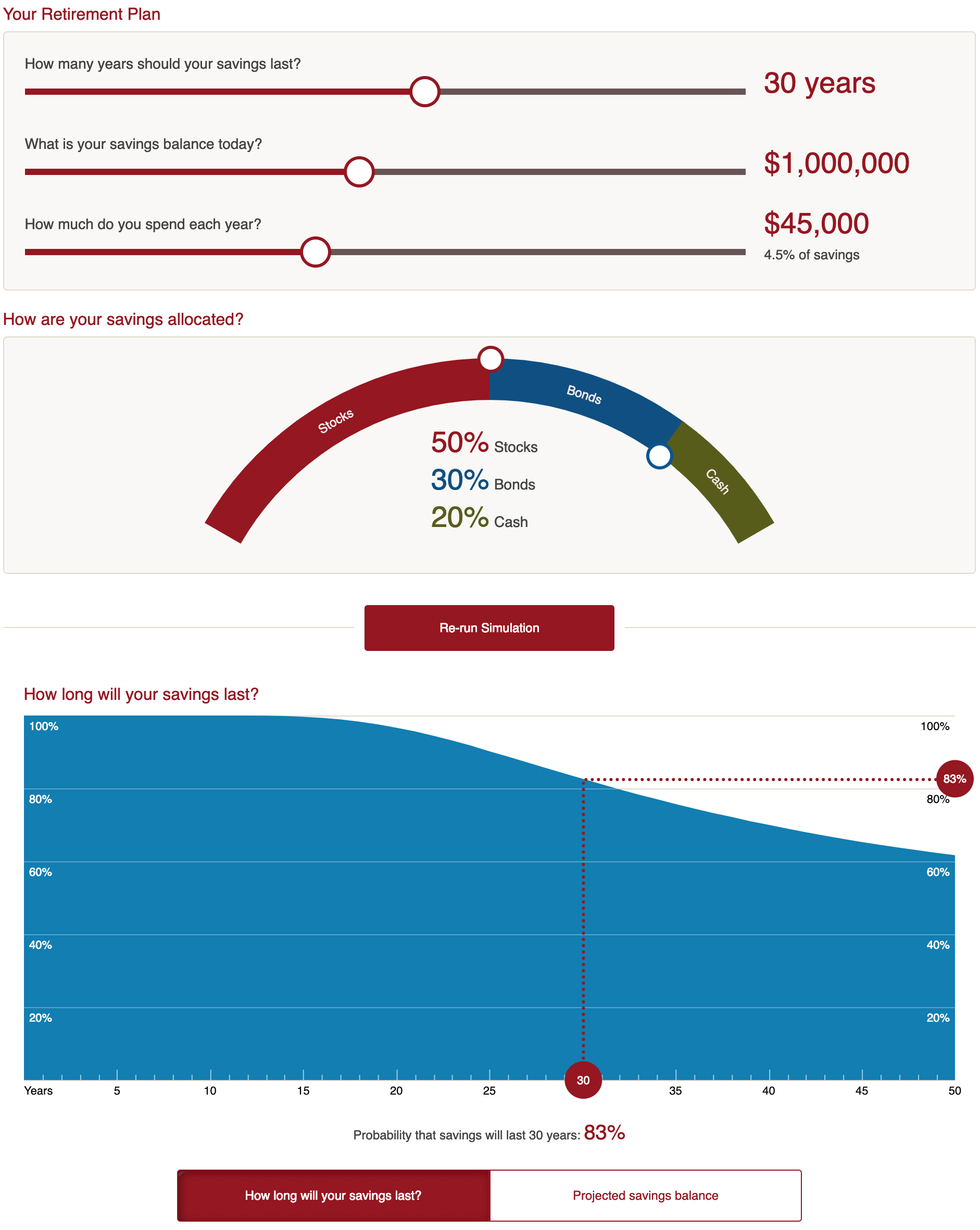

Fire Calculators App Our Debt Free Lives Retirement Calculator Budget Calculator 401k Retirement Calculator

Calculate Child Support Payments Child Support Calculator Parental Income Inf Child Custody Cal Child Support Quotes Child Support Child Support Payments

Tuesday Tip How To Calculate Your Debt To Income Ratio

When Can I Retire This Formula Will Help You Know Sofi

The 10 Best Retirement Calculators Newretirement

The 10 Best Retirement Calculators Newretirement

Earned And Unearned Income For Calculating The Eic Usa Earnings Income Annuity

How Much Is Ge Shortchanging Pensioners Taking Lump Sums Use Our Calculator Pensions Calculator Words Data Charts

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Using Guard And Reserve Retirement Calculators To Estimate A Reserve Pension Retirement Calculator Retirement Guard